Reimagine your data to

Turn Data into Wisdom.

ENABLING YOUR SINGLE DATAVERSE FOR - Approvals & Investments | Leasing & Marketing | Assets & Project Management | Risk & Compliance | Maintenance & Facilities | Sustainability & ESG

If you operate 20+ sites or have more than $200m AUM

You need Enterprise Grade Proptech for Your Enterprise Portfolio Information

PIPP.ai apps typically creates ROI within 12 months by removing the reliance on spreadsheets or dispersed SaaS silos.

In the world of AI and automation, you must regain ownership, control and governance of your data to create wisdom.

"PIPP.ai helped us unlock the potential of Microsofts Copilot we had been struggling to gain value from"

"Before PIPP.ai we were giving away our IP to competitors, letting other train AI with our Data"

"Managing 100's of different SaaS Protech vendors is not sustainable and create endless siloes"

50

B

Portfolio ($)

750

K

Connected Assets

104

M

Sq metres

405

M

kgCO2 Savings Identified

The ultimate enterprise data-driven real estate

platform

Fast track a Knowledge and Independent Information Layer by unlocking your "Dataverse"

Build-Apps created PIPP.AI with a purpose to enable enterprise real estate owners and occupiers to improve portfolio performance by unlocking and surfacing the insights hidden in their data.

We do this by connecting disparate data sources in their "Dataverse" and then surfacing only the insights that matter - on any device, anywhere, 24/7.

PIPP.ai is able to integrate with existing tools, structuring all information in a common data model to deliver meaningful actionable insights, from a worm eye view at property level to drive operational efficiency, to a birds eye view across operations and strategy to improve portfolio returns.

Discover Our Apps by Department

All our apps share knowledge within your Microsoft Dataverse meaning you AI capabilities are continually enhanced with each app deployed. All apps are code exposed meaning you can customise if needed for your own secret sauce, but we also love to get feedback too to improve apps for everyone.

Sustainability & ESG

Our ESG reporting tools have been developed in collaboration with government partners, enabling enterprises to achieve key metrics for a truly sustainable property portfolio. Not only do we have ESG criteria expertise from years of industry experience, we also employ AI integrations to track key metrics to provide automated status notifications and insights necessary for peak portfolio performance.

Our tools streamline ESG reporting with high accuracy with our patented process involving automatic mapping of UNSDGs across the CDM. This is augmented with real-time AI insights into building performance across property portfolios and our enterprise-tested database structure and information architecture.

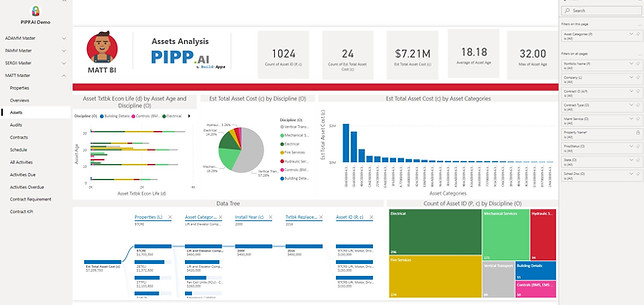

Assets & Project Management

Enhance data accuracy and bolster operations for CRE portfolios with our modular apps to achieve significant improvements in performance optimization. Utilize Digital Twin data models, IoT-based commissioning, and AI-based deep integrations to compile and analyse assets and projects effortlessly and efficiently.

Elevate your management strategies and teams by continuously monitoring and forecasting portfolio statistics with reference data such as asset lifecycles and project typologies.

Rein in all key asset and project data into a central command centre. Augment the value of your database by applying AI insights and automation to your enterprise processes and workflows.

.png)

CAMM

Commissioning Activity Matrix Manager

CAMM provides a holistic management system for the commissioning of building services within a property portfolio. Ensures the client intent is maintained and allows password access to contractors.

.png)

SITAA

Security of Information & Technology Analytical Assessor

SITAA aims is crack down on cyber security managing endpoints and API integration to ensure data is the creation of a data democracy keeps ICT teams happy with the level of security auditing undertaken.

.png)

MACC

Marketing and Advertising Collateral Collector

MACC loves to play with marketing and advertising information. From key facts and statements on individual properties to creating a curated and perfectly leasing portfolio image library.

.png)

ISLAA

Investments, Surveys, Leases, Adjustments and Annuities

ISLAA provides an overview of the leases across a portfolio. It can be used by landlord or tenant and creates a clear place to track and understand the leasing obligations and requirements.

Investments & Approvals

Managing the big picture of when to buy, sell and develop property needs visibility of a full data stack. Our processes provide an executive lens and framework from feasibility through to delivery.

Boost your performance by approving and measuring productivity using real-time reference data.

.png)

APRILL

Approvals, Procedures, Responses, Insights and Leverage Ledger

APRILL is for C-Suites of a large portfolios best friend. Creating sign off gates and approvals required for every part of development from Inception, Conversion, Delivery and into Operations.

.png)

FIONAA

Feasibilities, Investment, Ownership, Negotiations & Appraisal Assessor

FIONAA safeguards all core statistics and analytics to be communicated to investors, including financial projections, diversification and viability studies. Investor communications are also logged so portfolio managers can respond to queries on valuation, feasibility or co-ownership.

ROBB

Requirements and Offering for Base Buildings

ROBB maintains all building benefit data such as PCA office quality or NABERS ratings metrics, enabling business planning with concrete figures.

Equipped with the latest editions of classification tools, he makes managing and achieving property ratings across a portfolio effortless and efficient.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)